The luxury real estate market is at a critical point as we approach 2025. The market is changing due to shifting buyer preferences, economic factors, and global influences. It’s important for investors, real estate professionals, and potential buyers in the high-end property sector to understand these emerging trends.

Our analysis reveals eight key trends shaping the future of luxury real estate:

- – The rise of smaller, high-end properties

- – Market stabilization and inventory growth

- – Global market interconnectivity

- – Evolution in pricing and financing options

- – Strong second-home demand

- – Sustainable and resilient features

- – Millennial and Gen X influence

- – Innovative ownership models

These trends show that the luxury real estate landscape is changing. Traditional ideas of luxury are being redefined by new priorities, technologies, and market forces.

1. Smaller Luxury Homes on the Rise

Wealthy buyers are increasingly interested in smaller luxury homes, indicating a significant change in the high-end real estate market. These properties, usually between 2,500 and 3,500 square feet, provide top-notch features in smaller spaces.

Reasons Behind This Trend

Several key factors are contributing to this trend:

- Empty nesters looking to downsize without giving up on luxury

- Young professionals prioritizing location over square footage

- Increasing maintenance costs of larger estates

- Desire for sustainable living solutions

Advantages of Smaller Luxury Homes in 2025

The benefits of smaller luxury homes in 2025 go beyond lower maintenance:

- Efficient use of space with customized storage options

- High-quality finishes and top-of-the-line appliances

- Reduced energy expenses through efficient design

- Prime locations in desirable neighborhoods

- Lower property tax burden

These properties blend elegant design with practical living, featuring chef’s kitchens, home offices, and spa-like bathrooms in well-designed floor plans. The trend signifies a wider movement towards purposeful luxury living, where quality and convenience take precedence over sheer size.

2. Stabilization of Luxury Housing Market

The 2025 luxury housing market shows clear signs of stabilization, with a significant increase in available inventory across prime locations. There are 15-20% more luxury properties on the market compared to previous years, creating a balanced environment for both buyers and sellers.

Shift from Bidding Wars to Measured Negotiations

The days of intense bidding wars are shifting to a more measured pace. Properties in the $5M+ range now spend an average of 45 days on market – a stark contrast to the 7-10 day turnaround seen in recent years. This cooling effect allows buyers to:

- – Conduct thorough property inspections

- – Negotiate favorable terms

- – Make informed investment decisions

- – Explore multiple options before committing

Price Adjustments and Opportunities for Buyers

The market’s newfound balance brings price adjustments in select regions, with some luxury properties seeing 5-10% reductions from their peak asking prices. This stabilization creates opportunities for strategic buyers while maintaining strong fundamentals for long-term value appreciation.

3. Globalization of Luxury Real Estate Trends

The luxury real estate landscape in 2025 reflects an unprecedented level of global mobility. A significant 35% of American high-net-worth individuals are actively exploring international property investments, with destinations like Portugal, Spain, and Mediterranean coastal regions leading their preferences.

Foreign investors continue to shape the US luxury market dynamics. Chinese, Canadian, and Middle Eastern buyers represent the largest groups of international investors, focusing on prime locations in New York, Miami, and Los Angeles. These investments have pushed property values up by 15-20% in select metropolitan areas.

The cross-border flow of luxury real estate investments has created new opportunities:

- Digital Property Tours: Virtual reality platforms enable remote property viewings across continents

- International Banking Solutions: Specialized mortgage products for cross-border transactions

- Global Property Management: Rise of tech-enabled services managing international property portfolios

The globalization trend has sparked innovative investment strategies, with luxury property buyers diversifying their portfolios across multiple countries. This geographical diversification serves as a hedge against regional market fluctuations and political uncertainties.

4. Changes in Luxury Home Pricing and Financing

The US luxury real estate market is expected to experience significant price adjustments in 2025. Market data suggests a 15-20% slowdown in price growth across prime locations, creating new opportunities for strategic buyers.

Competition for Traditional Cash Purchases

Innovative financing solutions are now competing with traditional cash purchases:

- Private banking partnerships offering tailored mortgage products

- Cryptocurrency-backed loans gaining acceptance

- Fractional ownership financing options

- Asset-based lending programs

The Impact of Interest Rates on Luxury Market Dynamics

Interest rates have a significant impact on the luxury market. Buyers are becoming more patient and timing their purchases based on rate fluctuations. This strategic approach has resulted in a “wait-and-see” pattern in the $10M+ segment, where even a 1% change in rates can lead to millions in long-term costs.

A Shift in Luxury Financing Trends

The luxury financing landscape is undergoing a noticeable shift – 60% of high-net-worth buyers are now exploring mortgage options, compared to 40% in previous years. This trend indicates a more sophisticated approach to wealth management, with buyers using debt as a means to maintain investment liquidity.

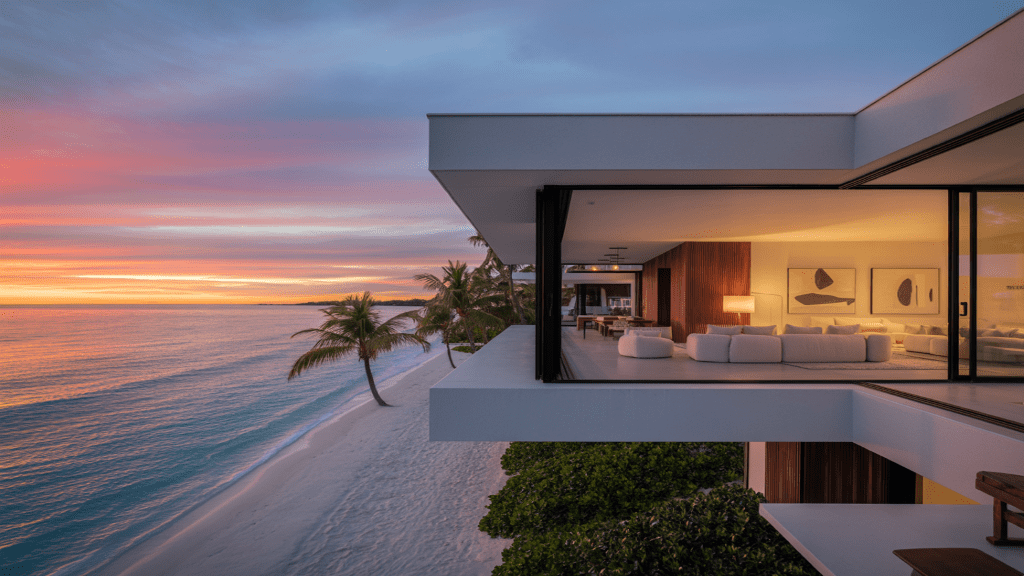

5. Demand for Luxury Second Homes

The luxury second home market shows remarkable resilience in 2025, driven by the sustained popularity of remote work arrangements and a desire for diverse lifestyle options.

Popular Second Home Destinations:

- Coastal Florida properties with year-round sunshine

- Mountain retreats in Colorado and Idaho

- Urban penthouses in emerging metropolitan areas

Remote work capabilities have transformed second homes from occasional retreats into flexible living spaces. Affluent buyers seek properties that serve multiple purposes – from weekend getaways to extended stays.

Key Market Drivers:

- Investment diversification opportunities

- Lifestyle flexibility

- Income potential through luxury rentals

- Tax advantages in certain locations

The second home landscape has evolved with buyers prioritizing locations offering both natural beauty and strong internet connectivity. Properties near water bodies command premium prices, while mountain destinations attract those seeking privacy and outdoor recreation options.

6. Sustainable and Resilient Features in Luxury Real Estate

Sustainability has become a key feature of luxury real estate in 2025. Wealthy buyers are looking for properties that have:

- Solar panel systems integrated with smart energy management

- Advanced water recycling and rainwater harvesting systems

- Living walls and sustainable landscaping designs

- Electric vehicle charging stations with battery storage capabilities

The emphasis on resilient features shows a practical approach to luxury living. Properties now include:

- Storm-rated roofing systems reducing repair costs by 30%

- Impact-resistant windows rated for extreme weather conditions

- Fire-resistant building materials and advanced fire suppression systems

- Backup power generation with renewable energy storage

These sustainable and resilient features greatly increase the value of luxury properties. Buyers understand the advantages of minimizing environmental impact and improving property protection. The use of eco-friendly materials – such as recycled steel and sustainable bamboo – adds unique design elements while preserving the high-end look expected in luxury real estate.

7. Influence of Millennials and Gen Xers on Luxury Market

Millennials and Gen Xers are driving significant changes in the luxury real estate landscape. These generations prioritize:

- Smart Home Integration: Demand for voice-controlled systems, automated security, and IoT-connected appliances

- Digital-First Transactions: Preference for virtual tours, digital documentation, and blockchain-based property transfers

- Work-Life Balance Features: Dedicated home offices with high-speed connectivity and professional-grade video conferencing setups

The impact of these younger luxury buyers extends beyond technology:

- Social Media Influence: Properties must be “Instagram-worthy” with unique architectural elements and photogenic spaces

- Flexible Spaces: Multi-purpose rooms that adapt to changing lifestyle needs

- Community Connection: Emphasis on walkable neighborhoods and social gathering spaces

These demographic groups value authenticity and personalization in their luxury homes, pushing developers to create properties that blend cutting-edge technology with individualized design elements.

8. Co-Ownership Models and Diversification Strategies

Co-ownership platforms like Pacaso have changed the game for luxury real estate, making it easier for buyers to invest in high-end properties by purchasing shares instead of whole units. This new approach significantly lowers the initial investment required, making it possible for more people to access exclusive vacation homes without breaking the bank.

Investment Diversification Opportunities in Luxury Real Estate

Investing in luxury real estate offers several opportunities for diversification:

1. Property Type Mix

- Multi-family luxury developments

- High-end commercial spaces

- Premium vacation rentals

2. Geographic Expansion

- Emerging luxury markets

- International property holdings

- Strategic location arbitrage

Real estate investment trusts (REITs) that focus on luxury properties provide another way to diversify your investment portfolio. These professionally managed funds pool together various assets, giving investors exposure to a wide range of global properties without the need for direct ownership. This appeals to those looking for potential appreciation in value as well as consistent income generation.

The luxury real estate market has shown resilience during economic downturns, with prime property values historically outperforming traditional segments by 50%.

Conclusion

The luxury real estate market of 2025 presents a dynamic landscape shaped by evolving buyer preferences, technological advancements, and global economic shifts. The trends we’ve explored paint a picture of an industry adapting to meet sophisticated demands while embracing accessibility and sustainability.

Key Market Indicators for 2025:

- Smaller luxury properties gaining market share

- Stabilized pricing with increased inventory options

- Global investment opportunities expanding

- Sustainable features becoming standard expectations

- Tech-savvy millennials driving market innovation

- Co-ownership models revolutionizing accessibility

The market’s transformation reflects deeper societal changes – from remote work culture to environmental consciousness. Buyers now seek properties that blend luxury with practicality, sustainability with smart technology, and exclusive ownership with shared opportunities.

These shifts signal a resilient market poised for strategic growth. Whether you’re an investor, buyer, or industry professional, understanding these trends positions you to make informed decisions in the evolving luxury real estate landscape.

The future of luxury real estate lies not just in opulent features but in creating meaningful value through innovative ownership models, sustainable practices, and adaptable living spaces. As we move toward 2025, the market continues to redefine luxury while maintaining its core appeal of exclusivity and quality.