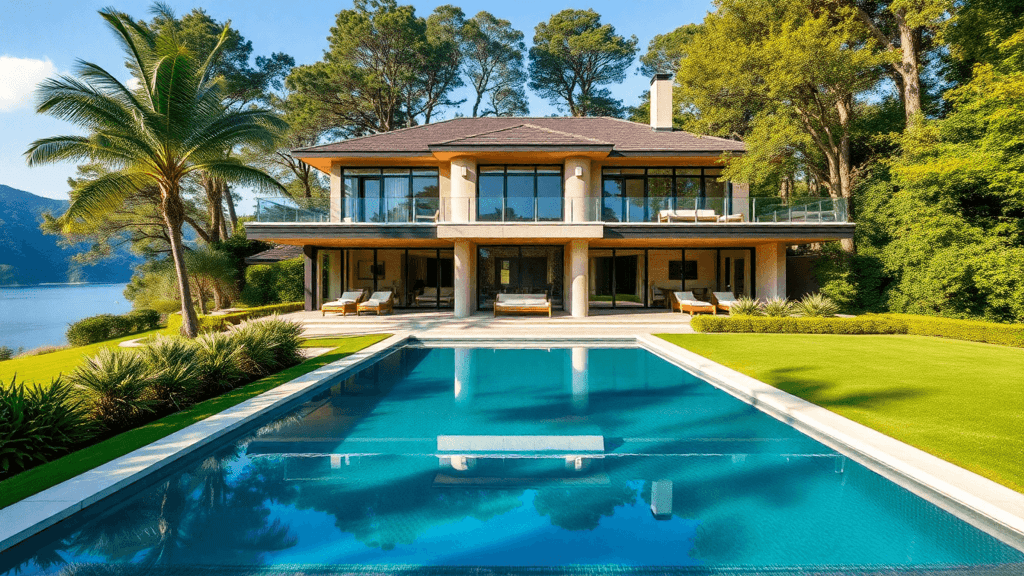

The dream of owning a luxury vacation home has taken an intriguing turn. High-net-worth individuals are increasingly turning to luxury home co-ownership – a model that promises the prestige of owning a multi-million dollar property at a fraction of the cost.

Real estate agents paint a rosy picture of this ownership model:

- Access to stunning properties in prime locations

- Reduced financial commitment compared to full ownership

- Professional property management services

- Shared maintenance responsibilities

But here’s what they might not tell you…

Behind the glossy brochures and compelling sales pitches lie crucial details that could impact your investment decision. While agents eagerly highlight the benefits of splitting costs and accessing premium real estate, they often gloss over complex fee structures, resale challenges, and community resistance issues.

The reality of luxury home co-ownership extends far beyond the initial purchase price and basic maintenance fees. From hidden markups to scheduling limitations, from tax implications to zoning challenges – these aspects rarely make it into the initial sales conversation.

This guide pulls back the curtain on luxury home co-ownership, revealing the untold truths you need to know before committing your money. You’ll discover the essential facts that real estate agents might conveniently overlook, empowering you to make an informed decision about this unique investment opportunity.

Understanding Luxury Home Co-Ownership

Luxury home co-ownership is changing the way wealthy people buy and own expensive properties. Instead of one person owning 100% of a property like in traditional ownership, co-ownership splits a luxury home into shares that are legally owned through an LLC (Limited Liability Company) structure.

Key Features of Luxury Home Co-Ownership:

- Legal ownership through LLC shares

- Professional property management

- Scheduled access rights

- Shared maintenance responsibilities

- Reduced individual capital requirements

Pacaso is the leading company in this field, changing how rich buyers think about owning a second home. The company buys high-end properties and sets up individual LLCs, selling fractional shares to a maximum of eight co-owners. Each share usually allows for 44 days of property usage each year.

The Pacaso Model Breakdown:

- 1/8 ownership shares starting at $400,000

- Dedicated mobile app for stay scheduling

- Professional interior design and furnishing

- Local property management

- Owner support services

With this model of fractional ownership, you can now own a portion of properties that were previously unaffordable. For example, instead of needing $4 million to buy a beach house outright, you can now invest $500,000 for a share and have access to prime locations such as Malibu, Aspen, or the Hamptons.

Benefits of Fractional Ownership:

- Reduced financial commitment

- Professional property maintenance

- No need for full-time property management

- Access to higher-value properties

- Shared carrying costs

The co-ownership structure creates a sophisticated ownership experience. You gain access to a fully-furnished, professionally managed property without the traditional burdens of second-home ownership. The property management team handles everything from cleaning to repairs, while the scheduling system ensures fair usage distribution among owners.

This ownership model particularly appeals to buyers seeking luxury vacation homes without the full financial and management responsibilities. Each owner receives a deeded property share, distinguishing this arrangement from timeshares or vacation clubs.

The Hidden Costs and Markups in Luxury Home Co-Ownership

The true cost of luxury home co-ownership extends far beyond the initial purchase price. Let’s uncover the hidden expenses that real estate agents might gloss over during their sales pitch.

Maintenance Fees: The Ongoing Burden

Monthly maintenance fees range from $500 to $2,500 per share and cover various expenses such as:

- Professional property management services

- Regular cleaning and landscaping

- Utilities and insurance costs

- Emergency repairs and replacements

- Annual property assessments

Closing Expenses: The Upfront Hit

In addition to the ongoing maintenance fees, there are also upfront closing expenses that you need to consider. These costs include:

- Title insurance premiums (proportional to share value)

- LLC formation and legal documentation fees

- Property inspection costs

- Mortgage origination fees (if financing)

- Transfer taxes and recording fees

- Escrow account setup charges

Furnishing Costs: The Surprising Expense

Your share of furnishing costs can reach surprising heights in luxury properties. A typical high-end home requires:

- Designer furniture: $100,000-$300,000

- Smart home technology: $25,000-$50,000

- Custom window treatments: $15,000-$30,000

- High-end appliances: $50,000-$100,000

- Art and décor: $25,000-$75,000

Market Price Markups

It’s important to note that the price per share often exceeds the proportional market value due to various factors such as:

- Company service fees (15-20% markup)

- Property acquisition costs

- Marketing expenses

- Platform development costs

- Operating expenses

Tax Implications You Need to Know

As a co-owner, you have certain tax obligations that you need to be aware of:

- Property taxes (pro-rated by ownership share)

- Local occupancy taxes

- Capital gains tax on appreciation

- State-specific transfer taxes

- Special assessments

- Income tax on rental revenue (if applicable)

Real estate agents rarely mention that luxury co-ownership properties typically appreciate at slower rates than traditional single-owner homes. The markup structure creates an immediate paper loss on your investment, requiring significant market appreciation to break even.

The shared ownership model also impacts your ability to claim certain tax deductions. You’ll need specialized tax advice to navigate complex ownership structures and maximize available benefits. Some co-owners face unexpected tax bills when selling their shares, particularly in states with specific regulations for fractional

Resale Challenges and Community Acceptance Issues in Luxury Home Co-Ownership

Selling your share in a luxury co-owned property comes with its own set of challenges that real estate agents often don’t mention right away. Here are some key issues to be aware of:

1. Minimum Holding Period

Most co-ownership agreements have a rule that you must hold onto your share for at least 12 months before you can sell it. This means if your financial situation changes or you’re unhappy with the arrangement, you won’t be able to sell right away.

2. Rights of First Refusal

When you decide to sell your share, the other co-owners have the first chance to buy it before you can sell it to someone else. This can lead to delays in your sale process and may also limit the number of potential buyers and impact your ability to negotiate the best price.

3. Community Resistance

Residential neighborhoods often push back against properties with multiple owners, viewing them as disruptive to community dynamics. Common complaints include increased traffic and parking issues, constant turnover of occupants, noise from different families cycling through, and reduced sense of permanent community.

However, it’s important to remember that such resistance could potentially violate the Fair Housing Act, which prohibits discrimination in housing-related transactions.

4. Zoning Regulations

Many residential areas have strict laws that only allow single-family homes. These laws can restrict the number of unrelated people living in a house, limit short-term stays, require special permits for multiple owners, and set specific schedules for when people can occupy the property.

Some local governments have started creating specific rules targeting co-ownership arrangements. These regulations can include restrictions on how long people must stay, additional parking requirements, noise control measures, and limits on the number of ownership shares allowed.

5. Legal Battles

In some luxury markets, local government resistance has led to legal battles where communities have successfully blocked or limited co-ownership arrangements. This creates uncertainty about how viable your investment will be in the long run and could potentially affect property values.

Understanding these challenges is important when considering whether luxury home co-ownership aligns with your long-term financial goals.

Flexibility, Financial Considerations, and Suitability for Different Investor Profiles in Luxury Home Co-Ownership

Limited Location Options

Location flexibility presents a significant limitation in luxury home co-ownership models. Unlike traditional vacation property investments where you can choose from countless destinations, co-ownership restricts your options to pre-selected properties in specific locations. This constraint becomes particularly evident when comparing with private residence clubs or luxury hotel memberships that offer access to multiple properties worldwide.

- Fixed property selection within specific markets

- Inability to switch between different destinations

- Restricted access to emerging luxury markets

- Dependence on company expansion for new location options

Investor Suitability Analysis

The financial dynamics of luxury home co-ownership create a unique investment profile that may not suit all types of investors. High-net-worth individuals seeking prestige assets often find the model attractive, but other investor profiles face distinct challenges.

Ideal for:

- Wealthy professionals seeking occasional luxury stays

- Investors comfortable with illiquid assets

- Buyers prioritizing property prestige over financial returns

- Those seeking reduced maintenance responsibilities

Less suitable for:

- Income-focused investors requiring rental revenue

- Frequent travelers needing multiple destination options

- Value investors seeking appreciation potential

- Those requiring quick asset liquidation

Financial Considerations

The risk-return profile differs significantly from traditional real estate investments. Co-ownership shares typically appreciate at slower rates than whole property ownership, impacting potential returns. The absence of rental income opportunities limits passive revenue generation, making this model primarily a lifestyle investment rather than an income-producing asset.

- Limited potential for capital appreciation

- No rental income streams

- Higher per-use costs compared to hotel stays

- Complex valuation metrics for resale

Investment success depends heavily on matching your profile with the model’s characteristics. A thorough assessment of your financial goals, usage patterns, and risk tolerance becomes crucial. The ideal investor values luxury experiences over investment returns and maintains sufficient portfolio diversification to offset the limited liquidity of co-owned properties.

Risk appetite plays a central role in determining suitability. Conservative investors might find the combination of high entry costs and limited exit options challenging. The model works best for those who can afford to lock capital in a lifestyle asset without relying on it for income or quick liquidation needs.

Conclusion

The shared ownership model of luxury homes presents both opportunities and challenges that real estate agents might not readily disclose. Your path to successful co-ownership investment requires:

- Independent Research: Look beyond the glossy marketing materials and agent presentations. Investigate community regulations, zoning laws, and local market conditions.

- Professional Guidance: Seek advice from:

- Tax specialists familiar with fractional ownership

- Real estate attorneys experienced in co-ownership agreements

- Financial advisors who understand luxury property investments

- Thorough Due Diligence: Examine:

- Historical maintenance costs

- Property management track records

- Resale data in similar co-owned properties

- Community acceptance rates in target locations

The undisclosed complexities of luxury home co-ownership can significantly impact your investment experience. Real estate agents might not tell you about the intricate scheduling systems, potential conflicts with co-owners, or the true costs of maintaining a high-end property.

Your decision to invest should align with your lifestyle goals, financial capabilities, and risk tolerance. Consider creating a detailed checklist of your expectations and requirements before committing to any shared ownership arrangement. Remember – the right investment structure for you might differ from what your real estate agent recommends.